BISP Expands Payment Network with Six Banks Latest Update 2024

The Benazir Income Support Programme (BISP) is working with six new banks to enhance the easy nature of beneficiary payments, thus lowering theft and being more open in the process, according to BISP Chairperson Senator Rubina Khalid.

New Payment Model

BISP worked together with six new banks to solve concerns like as stops and waste, including Bank Al Falah, Bank of Punjab, Mobilink Microfinance, Telenor Microfinance Bank, Habib Bank Limited (HBL), and HBL Microfinance. The partnerships aim to make payments more accessible to beneficiaries through the provision of transfers between JazzCash and EasyPaisa wireless wallets and bank accounts, hence improving complaints and maximizing the method of payment.

| BISP Expands Payment Network with Six Banks (2024) | Details |

| New Payment Model | BISP adds six banks to improve payment access and efficiency. |

| Transparency | Digital payment systems and campsites ensure fair, tracked, and corruption-free payments. |

The motives of an association

The partnership with more banks looks to give beneficiaries more payment choices. while also improving transparency and reporting in the payment process. The formal contracts were inked at an event attended by BISP Director General Naveed Akbar and officials from partner banks.

Promoting Transparency and Less Graft

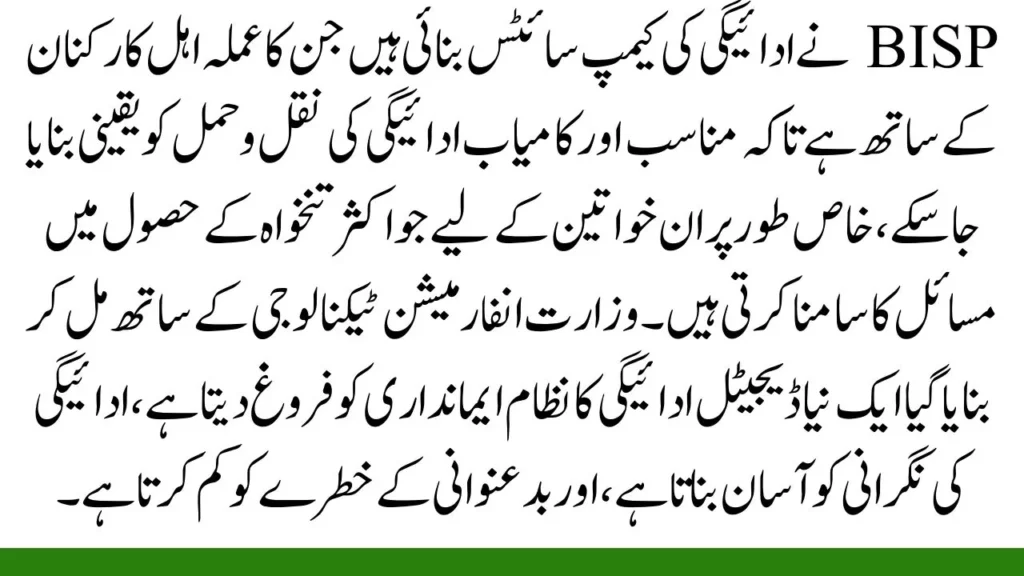

BISP has built payment campsites staffed by qualified workers to ensure equitable and successful payment transportation, notably for women who are often experiencing issues getting a salary. A new digital payment system created together with the Ministry of Information Technology promotes honesty, makes it easier payment monitoring, and reduces the risk of corruption.

The return of the Poverty Higher education Program

BISP is back in the Lack of Opportunities Graduation Program, offering vocational training to 9.3 million Pakistani families. The attempt strives to assist persons become self-sufficient by providing opportunities for them to make a living while catering to their families. Students can select the skills that best fit their interests and demands.

Digital Payment Solution

BISP has implemented a digital payment system, partnering with MOIT, to ensure efficient and accurate processing of payments. The system also facilitates better fund tracking, enabling the detection and resolution of irregularities, thereby aiding in corruption prevention and ensuring smooth payment delivery to beneficiaries.

Benefits of the New Payment Model

BISP Payment System Update:

- Six new banks were added.

- Offers multiple payment options.

- Reduces reliance on POS agents.

- Improves participant experience.

- Provides more fund access flexibility.

Conclusion

The BISP has added six more banks to its payment model, aiming to enhance efficiency and transparency. This move includes more payment options and payment campsites, reducing complaints and ensuring fair treatment for all beneficiaries. The return of the Poverty Graduation Program further demonstrates BISP’s commitment to assisting participants in improving their living conditions.

Also Read: Latest News: BISP Kafalat Payments Set for August 2024

FAQs

Which of the banks have become part of the BISP payment system?

Banks right now engaging in the BISP payment scheme include Bank Al Falah, Bank of Punjab, Mobilink Microfinance, Telecom Microfinance Bank, Habib Bank, Ltd. (HBL), and HBL Microfinance.

What is considered the objective of the new payment campgrounds?

The funding campsites were formed to enhance transparency and efficacy in the dispensing of BISP stipends, so minimizing corruption and beneficiary child abuse.

How can the digital payment option help?

The online payment system, created in partnership with MOIT, will improve payment tracking and handling, boosting openness and eliminating graft.